The Facts About Hard Money Georgia Uncovered

Wiki Article

The Buzz on Hard Money Georgia

Table of ContentsHard Money Georgia - An OverviewFacts About Hard Money Georgia UncoveredSome Ideas on Hard Money Georgia You Should KnowTop Guidelines Of Hard Money Georgia

Considering that difficult cash lendings are collateral based, also recognized as asset-based financings, they call for very little paperwork as well as allow capitalists to shut in a matter of days. Nevertheless, these car loans come with even more danger to the loan provider, as well as therefore call for higher deposits and also have greater rates of interest than a typical finance.Along with the above failure, tough cash financings and also conventional home loans have various other differences that distinguish them in the minds of financiers and also loan providers alike: Hard cash finances are moneyed faster. Numerous traditional lendings might take one to 2 months to close, however difficult cash car loans can be enclosed a couple of days.

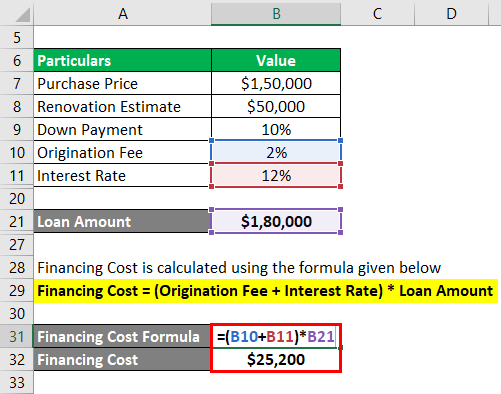

Many tough money finances have brief repayment periods, typically in between 1-3 years. Traditional home loans, in comparison, have 15 or 30-year settlement terms typically. Difficult money finances have high-interest prices. Most hard cash car loan rate of interest prices are anywhere in between 9% to 15%, which is considerably more than the rate of interest you can expect for a conventional mortgage.

When the term sheet is authorized, the financing will certainly be sent out to processing. During financing handling, the lender will certainly request files and prepare the financing for final funding evaluation and also routine the closing.

The smart Trick of Hard Money Georgia That Nobody is Discussing

Essentially, because individuals or companies provide tough cash car loans, they aren't based on the same rules or restrictions as financial institutions as well as credit score unions. This means you can get special, personally customized tough cash car loans for your specific needs. That stated, hard money loans have some drawbacks to bear in mind before seeking them out.You'll require some capital upfront to qualify for a difficult money car loan as well as the physical property to offer as collateral. In addition, hard cash financings generally have greater passion rates than traditional home mortgages.

Typical exit approaches include: Refinancing Sale of the property Payout from various other resource There are many scenarios where it may be useful to use a difficult money finance. For beginners, investor that like to house turn that is, acquire a run-through house in demand of a great deal of work, do the job directly or with professionals to make it much more beneficial, after that reverse as well as sell it for a greater price than they purchased for may find tough money lendings to be perfect financing options.

Since of this, they do not require a lengthy term and also can stay clear of paying also much interest. If you buy investment residential properties, such as rental homes, you might likewise locate tough cash financings to be excellent options.

The smart Trick of Hard Money Georgia That Nobody is Discussing

In many cases, you can likewise use a tough money financing to buy vacant look at this now land. This is an excellent choice for developers that are in the procedure of certifying for a building car loan. Note that, also in the above situations, the possible drawbacks of tough cash fundings still apply. You have to be certain you can pay back a tough cash lending prior to taking it out.

Difficult money fundings normally come with higher interest prices and also much shorter settlement timetables. So, why choose a tough cash loan over a standard one? To address that, we must initially take into consideration the benefits as well as downsides of hard cash lendings. Like every economic device, hard cash financings included advantages as well as disadvantages.

Hard Money Georgia - Truths

Furthermore, due to the fact that exclusive people or non-institutional lenders provide difficult money financings, they are exempt to the exact same guidelines as standard lending institutions, that make them extra high-risk for borrowers. Whether a hard cash funding is ideal for you depends upon your circumstance. Tough cash loans are excellent alternatives if you were rejected a click this traditional funding and require non-traditional funding.Get in touch with the skilled home loan advisors at Right Beginning Mortgage. hard money georgia for additional information. Whether you intend to acquire or re-finance your residence, we're right here to assist. Get going today! Request a totally free individualized price quote.

The application process will generally include an analysis of the building's value as well as potential. In read the full info here this way, if you can't manage your settlements, the tough money lending institution will just relocate ahead with offering the residential or commercial property to redeem its investment. Difficult money loan providers typically charge greater rates of interest than you would certainly have on a traditional financing, however they additionally fund their finances quicker as well as usually need much less paperwork.

As opposed to having 15 to thirty years to settle the funding, you'll typically have simply one to 5 years. Hard cash lendings work fairly in different ways than typical lendings so it is necessary to comprehend their terms and also what transactions they can be utilized for. Difficult cash lendings are commonly planned for investment buildings.

Report this wiki page